- Self-service

- Banking details and fees

- Balances and settlements

- Payment problems

- Greenbacks

My account in my hands

For 24/7 access to your MFC account, register for our secure, self-service platform.

-

Keep your personal and account details up to date

-

Get your account balance or settlement amount instantly by email or SMS

-

Access your finance-related tax documents or cross-border letter whenever you need

Already have an MFC account?

Follow this easy guide to link your account for 24/7 access.

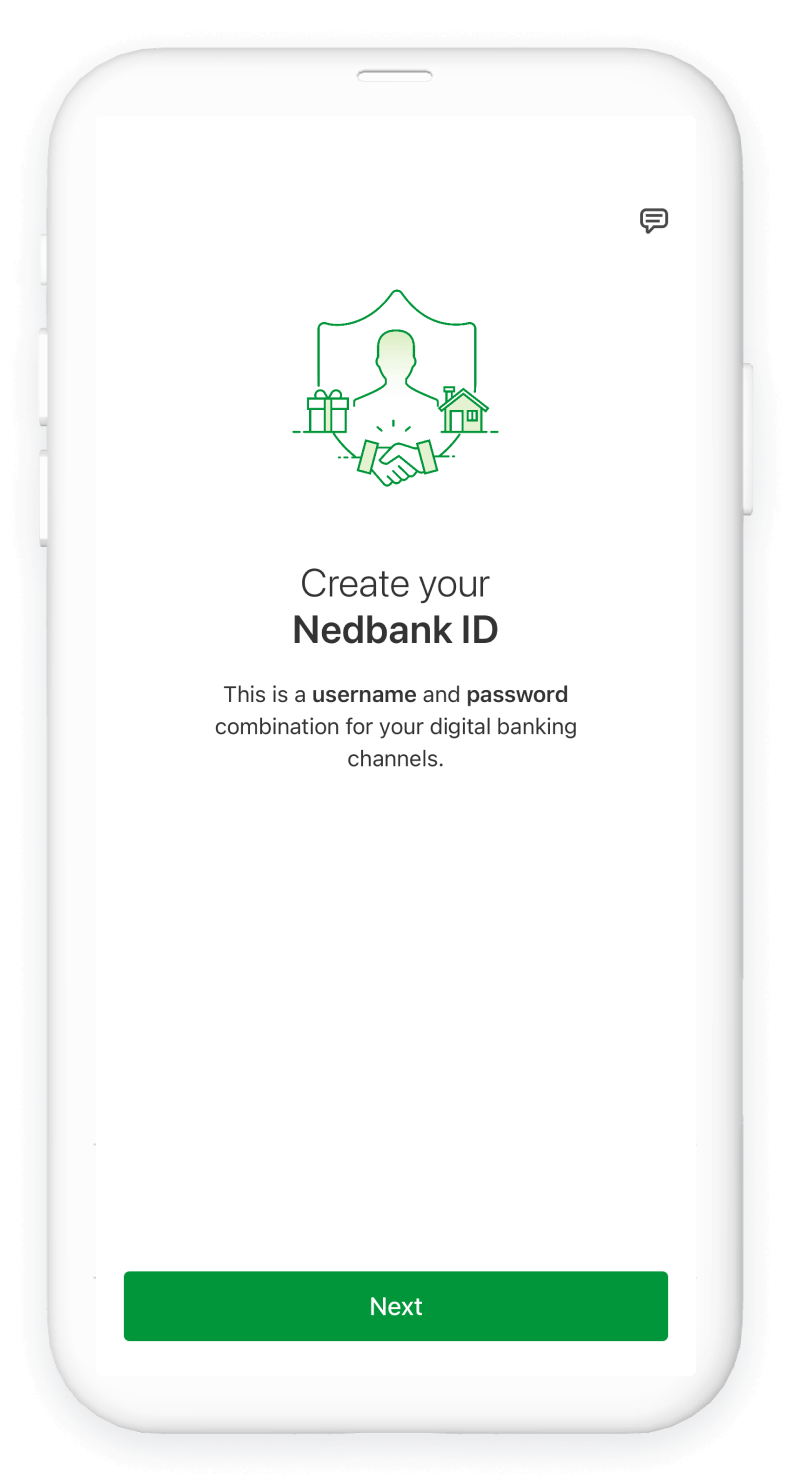

Step 1: Register for a Nedbank ID

Your Nedbank ID is a secure single sign-on that grants you access to a range of digital banking services, including the MFC self-service platform.

It takes just minutes to apply for a Nedbank ID online or on the Money app.

Register nowStep 2: Link your account

If your MFC account is not immediately available on your dashboard, you can follow the guide below to complete your setup.

You can also link your account and access all your account management features using Online Banking.

Log in to Online Banking

To link your account from the Money app

- Log on to the app using your Nedbank ID, app PIN or biometrics.

- Select More at the bottom of your screen

- Select Settings then go to Account settings and choose to Link accounts.

- Select your MFC account under the linkable accounts that will appear

Paying your account

There are several convenient ways to make payments to your MFC account.

Understanding your fees

All MFC asset and vehicle finance agreements include the following fees, in line with the National Credit Act, 34 of 2005:

- A R69.00 monthly administration fee

- A R1,207.50 once-off initiation fee

The monthly administration fee will be included with your monthly loan repayment. The initiation fee can be financed as part of your total loan amount or paid separately.

Request a balance or settlement

Stay informed with My Account in my hands™ . The SMS and email functionality My Account in my hands™ allows existing clients to request a settlement amount or total outstanding balance to end the contract by sending an SMS or email.

Just follow these easy steps and have your settlement figure or balance sent directly to you without contacting the call centre.

Troubleshooting

There are certain instances where the system will not send the settlement amount or outstanding balance to you but advise you to contact the MFC Service Centre or await a response from our service centre.

Payment problems?

Here's what you can do.

We understand that unplanned events can impact your budget. If the unexpected has happened and you're experiencing financial challenges, the following options are available to you.

Need help with payment problems?

Call us on 0860 879 900 or submit a contact form and we'll be in touch.

You can also read our payment problems FAQ to get answers to some common questions about:

- Arrear accounts

- Border letters

- Debt review accounts

- Deceased estates

- Legal accounts

- Payment takeovers

- Repossessions

- Vehicle registration paper problems

Earn more Greenbacks

Increase your Greenbacks level by making your vehicle or asset finance payments on time every month. This means more Greenbacks to spend and even bigger discounts from our rewards partners.

Ready to earn? See how it works.

Go now

Stay in control of your car and your money

Having your own set of wheels means the freedom to move from A to B whenever you need to. To stay on the move even on a rainy day, why not open a savings or investment account for that little extra cash that might come in handy if you need a quick repair or to top up your petrol out of budget?

Banking is easier on-the-go

Whether it's managing your MFC account or doing your everyday banking, our digital channels offer a secure, seamless way for you to stay on top of your finances, anytime, anywhere.